This article refers to a specific scheme existing in French law; equivalent procedures may not exist in other territories.

Definition

–> The contribution in possession consists in making available to a company a tangible or intangible asset for a limited time. It is therefore only the use of the property that is granted to the company while the contributor remains the owner of the property. The duration is freely agreed between the parties in advance and inserted in the articles of incorporation. The contribution in possession can be made either during the establishment of the company or during its life. In consideration for this temporary contribution, the contributor will receive shares, which results in a capital increase. As a shareholder, the contributor will receive dividends.

–> It differs from the usufruct contribution which is based on a composite ownership of the concerned asset (such a division of ownership is common in French law).

–> The contribution in possession also differs from the license since it is irrevocable and non-transferable.

Achievement

–> The conditions linked to the achievement of the contribution in possession must be mentioned in the statutes or in a contribution agreement which will be annexed to the articles of incorporation.

Evaluation

To secure this contribution in kind, the assessment of the contribution in possession is governed by special rules.

–> In most of the cases, it will be appropriate to appoint a contribution auditor who will ensure that the value of the contribution is not overstated.

The valuation of the contribution will depend on the nature of the property, the benefits generated and of course the duration.

While the contribution of a tangible asset can be easily assessed, the valuation is more difficult for intangible assets such as:

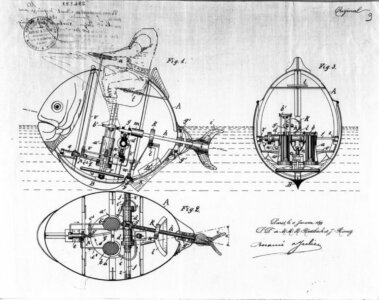

- Patents and associated know-how,

- Software,

- Trademarks and designs,

- Domain name and websites.

Different valuation methods and approaches may be applied. However, the economic aspects (market and forward-looking statements), legal and qualitative aspects must be considered in consistency.

These valuation studies must be entrusted to few specialized firms, duly referenced, including Brandon Valorisation.

Pros and cons

In the event of entry in collective proceedings, the owner of the intangible asset retains the possibility of recovering its property. It is a significant advantage when we think about the observed default rate, in particular for young companies.

However, the asset brought cannot be transferred or used as a collateral for obtaining a public financing or a private loan.

In the event of a conflict between the contributor and the shareholders / partners of the company leading to the exit of the contributor, it will be up to the parties to renegotiate the terms and conditions for the continuation of asset exploitation.