Due diligence is a legal term used to describe the risk assessment processes often deployed in investment transactions, corporate mergers and acquisitions etc. It makes it possible to answer the questions of the potential buyer prior to purchase and to assess the risks and negative impacts that he incurs by entering this project, and which could arise after the signature in addition to the guarantee of liabilities.

What is due diligence and its principles?

The purpose of due diligence, or prior audit, is to carry out any checks that may be required by the buyer to ensure the company’s health. It is more and more common during negotiations for equity investments as well as for sale or acquisition. It is carried out by qualified firms, including the Brandon Group, that study the right elements for the intended purpose.

This concept is born in the United States in the 1930s, where the Securities Act regulated the information that had to be provided by sellers during a transaction.

Among the risks that buyers wish to assess:

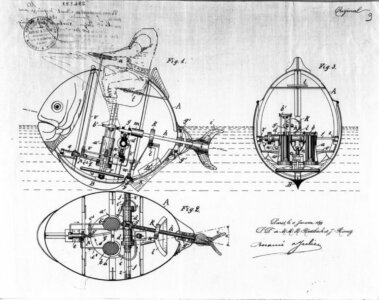

- Technical/Economic risks: it is important to be able to determine an appropriate purchase price. The acquirer of the company checks that it is not overvalued so as not to make a too large investment for a company whose tangible and intangible assets, such as patents, software, trademarks, etc., may have been poorly valued. A serious financial valuation study carried out by an expert allows to obtain a fair value for the company.

- Financial risks: does the company have any debts? Off-balance sheet commitments (deposits, guarantees)? Illiquid assets?

- Reputational risk: verifying the company’s image with its customers and partners is important. If it is used to working with partners whose practices are questionable, who are the subject of legal actions, or who have poor reputation, it may have negative consequences on the activity of the company and therefore its acquirer.

- Legal risks: it is necessary to verify compliance with regulations in the countries where the company is established, but also to be aware of any pending procedures and disputes.

Several types of due diligence

Depending on the project or the company that is targeted by the acquisition, we may need to evaluate the situation from different aspects, these are all types of due diligence:

- Financial due diligence: assessment of the company’s financial strengths and weaknesses, state of its profitability based on a study of the current and past situation (assets, debts, cash flow, etc.)

- Fiscal due diligence: analysis of tax risks (current, futures, changes in regulations, tax obligations, etc.)

- Legal due diligence: review of all legal documents and contracts involving the companies, such as contracts of employment, partnership agreements, agreements with customers and suppliers, company structure.

- Intellectual property due diligence: the state of the portfolio of patents, trademarks, models, and know-how constitutes an important stage of due diligence. Indeed, the value of some technology companies depends very much on the quality of their intangible assets. This part of the due diligence shall be entrusted to a referenced intellectual property consulting firm highly specialized in this field. Brandon IP meets these requirements.

- Commercial or market due diligence: the positioning of the enterprise on its market and its growth potential: market size, customers, competitors, suppliers, prospects resulting research and development, etc. The company’s image may be studied with customers.

- Operational due diligence: study of the company’s operational processes, in particular for industrial companies (supply chain, automation, credibility of the business plan …).

- Environmental due diligence: verification of the company’s compliance with the environmental regulations to which it is subject, but also of its impact on the environment, its ecological sustainability, its waste disposal methods, pollution hazards etc. It is then possible to evaluate the investments needed to achieve compliance, for example.

- Technical due diligence: very important when buying an industrial company, technical due diligence analyzes the tools and technical means used by the company, such as the type of machines, software, IT security, quality of the production etc. This helps to highlight the risks of defect, fire, hacking, or any other risk related to the technology. From this due diligence, we can deduce the cost of the investments necessary for improvement or replacement.

- Human resources due diligence: workforce, hierarchy, workstations, HR procedures, contracts, salaries, bonuses, or even business issues. The personality of decision-makers may be reviewed, as well as the risks of loss of skills in the event of massive departures following a takeover.

- Cultural due diligence: to study the corporate culture, which can have a definite impact on the integration into a new group with different practices.

These different forms of due diligence answer very specific questions that the purchaser must raise during an acquisition project.

They are important and allow him to protect himself against most hidden risks. A purchase made in a hurry and without taking any account of these prior assessments can be dangerous for the buyer, who could face legal problems or too large investments in compliance, thus weakening his own structure in the event of a merger.

Are you considering selling your business to a third party? Discover our different dedicated services:

The Brandon Group supports you in all your innovation efforts, from filing your patent or creating your business, to its development and disposal. Our financial valuation studies have a 100% success rate and are a prerequisite before any business transfer process. They attest to the value of the company based on precise figures and analysis, strengthen the position of the enterprise during negotiations and reassure the potential buyer.

To know more: