We carry out financial valuation studies of intangible assets which are often used by our clients to proceed to an in-kind contribution to the capital of their company.

But what is a contribution in kind? What is the role of the contribution auditor (in France)? Why mandate a consulting firm?

These are the questions we are going to answer in this article.

Capital contribution

A capital contribution is a good, for example money, real estate property, or a patent, that the associates make available to a company when it is created or its capital has increased.

As compensation for this contribution, the associates get shares of the company (two different kinds depending on the type of firm).

The company has its own holdings, separate from those of each of its shareholders.

So, contribution is transferred from the contributor’s holdings to those of the company.

Different sorts of contributions

- Cash contribution: it is a contribution of money which is deposited in a bank account in the name of the company. It forms the equity of a company.

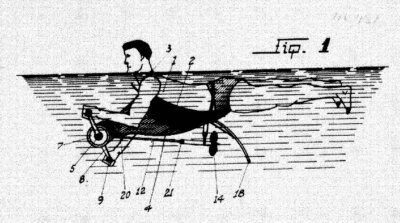

- In-kind contribution: It is a contribution of equipment, customer base, intellectual property (including patents, trademarks, software), etc. It forms the equity of a company.

- Sweat equity: it is a contribution in the form of labor, performed by one or more shareholders, like the provision of technical knowledge (know-how) or services. Under French law, sweat equity does not form the equity of the company. It enables the shareholders to get shares, with access to profit sharing and voting power.

In-kind contribution specificities

Unlike cash contributions, which are easily evaluated, assessing the value of an in-kind contribution necessitates a specific analysis and appraisal. Much is at stake here, because the stated value determines the number of shares obtained by the contributor.

In France, in most cases, the valuation of in-kind contributions must to be submitted for validation by a contribution auditor (“commissaire aux apports”). This serves as proof of an objective opinion on the evaluation process.

Some in-kind contributions also require specific formalities in addition to general contribution formalities. This is especially the case for contributions regarding industrial property.

The role of the French contribution auditor

In France, the contribution auditors (a regulated profession) are chosen from the list of experts of their tribunal’s court of appeal.

Their mission is to assess the value of the goods brought to a company when it is created or its capital increases.

In this context, they analyze the contribution and the evaluation process used and certify that the value of the contribution corresponds to the nominal value of the shares to be issued, and, if needed, the share premium.

Finally, they analyze the method used to evaluate the contributions in order to ensure complete objectivity of the stated value.

Why mandate a consulting firm?

In France, contribution auditors do not proceed to the financial valuation of the asset be contributed. To form their opinion, they rely on ta specialized consulting firm’s written report, which is based on material given by the company managers.

Mandating Brandon Valorisation means consulting a firm recognized in its specialty. It is a decisive choice for the company.

Our commitment is also to accompany the presentation of the study report on the valuation of the assets that will be contributed to the capital of the company to the contribution auditor. This phase thus reduces the risk of a decrease in or a rejection of the estimated value.

Would you like to know more about our financial valuation services for intangible assets?

Please visit the dedicated page of our website here or contact us: brandon@brandon-valorisation.com

And follow us on LinkedIn and Twitter.