What is the financial valuation of a company?

The term can refer to the value of the company as well as to the mathematical reasoning and calculation that led to this figure.

Hmm, mathematical? Does that mean that it is possible to translate into equations what makes a company unique, the innovativeness of its engineers, the talent of the designers, the quality of its products and services, the kindness and qualifications of salespeople, not to mention its involvement in terms of social and environmental responsibility?

In this article, we will try to learn more about this complex subject.

Why a valuation?

The need for a valuation may arise when a new partner or investor wants to enter, at the time of a takeover or a merger, for the creation of a spin-off company, or in court. Valuation is a part of the company life, whatever its size, whether listed or not.

What are the valuation methods for estimating the value of a company?

We distinguish 3 main approaches, very different in their principle and the results of which are not, in most cases, convergent.

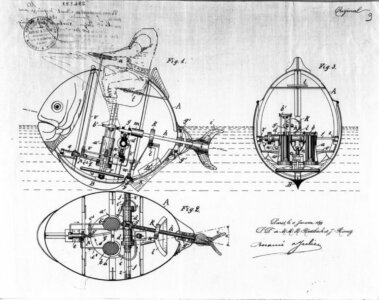

The valuation on net assets represents the patrimonial approach. This method requires to sum up the value of all assets and to take away the debts in the present moment. The operation is simple for tangible assets but much more complex for intangible assets such as patents, trademarks, software and business assets which all require an estimation of their fair value by a qualified expert.

The valuation on productivity represents the approach of immediate profitability. Given the profits generated by the company, considered to be constant in the future, and the expected return rate on investment, it is quite simple to calculate the amount a purely financial investor would be willing to pay to buy the company. The “x times the profits” operation has the advantage of being simple and tangible, but it is based on an assumption of stability (“business as usual”), not really plausible in the real economy.

The valuation on future cash flows (“discounted cash flows”) takes into account the corporate development lifecycle and thus represents the long-term profitability. Negative cash flows from the years of investment are added to positive cash flows from the years of operation (until the appropriate time) to obtain an overall view of the company’s profitability. A capitalization rate that is higher than the interest rates on government bonds helps compensate the risk inherent to the entrepreneurial adventure.

For completeness, we should also cite the comparison method, an ideal method which consists of calculating the value of an enterprise depending on the known value of a very similar company. However, it is rare to have such a reference at hand’s reach because each company has unique characteristics that contribute to its performance (market positioning, history, reputation, employees, etc.). This is especially true for start-ups or generally in the field of innovation.

Thus, each method has its own advantages and works more or less with any such company. Valuating a start-up with the same method and with the same parameters as a bakery or a centenary bank leads to aberrant results.

Who should you ask for a valuation of your company?

Chartered accountants are in good position to establish the annual balance sheet of the company and its current profitability. But it is not in their tasks to realize projections about the future financial situation. It is the job of actuaries and financial analysts, with higher fees.

Based on 30 years of experience in the financial valuation of intangible assets, we implement the same know-how to carry out the valuation of innovative start-ups and SMEs on the basis of their economic potential. It is done thanks to our proprietary method ValoFinTM and ValoFlashTM.

We know how to take into account the parameters that participate in the success of any project, including the values and human qualities of project holders. We also happen to work with mature companies and franchise network.

So, whatever your need for a company valuation, please do not hesitate to contact us.

To know more about our services and our financial valuation studies: